About The Report

Buying a used car can be tricky business.

Did you know that if you buy a used car with money owing to a financier from a previous owner, it could be repossessed? It’s true, if you don’t check for financial encumbrances (PPSR/REVS check) you could end up losing the car you have just purchased.

Before purchasing a used vehicle you should always do a PPSR/REVS check to see if there is any money owing on the vehicle you are buying.

For just $28.95, we provide you with a quick, easy-to-read, reliable, PPSR (previously REVS) check and an official PPSR Certificate, generated by the Australian government.

Want a more comprehensive history of your vehicle? Get our CarHistory car report

For only $39.95 you can get the most comprehensive report on a used car in Australia, online, in minutes.

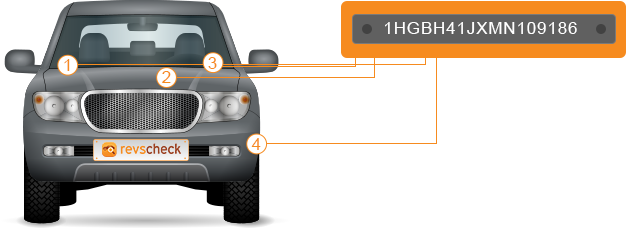

Just enter the Vehicle Identification Number (VIN) or Rego number in the search box to access an instant, single, easy-to-read report of the car's history.